Received in yesterday's mail:

Received in yesterday's mail:

Dear Natural Gas Royalty Owner,

This notice informs you of a class action against Columbia Natural Resources, Inc., Columbia Gas Transmission Corporation, Columbia Energy Group, Columbia Energy Resources, and all their predecessors, successors, subsidiaries and parents, including but not limited to Columbia Natural Resources, LLC, Chesapeake Appalachia LLC and NiSource, Inc., and a proposed settlement of the class action claims. For the sake of brevity and clarity, these companies will be referred to for the remainder of this notice simply as “Columbia” or “Defendants,” except where it is necessary to distinguish among them. This notice describes the class action and proposed settlement, and informs you of your rights as a class member. You are being sent this notice because you were identified as a Natural Gas Royalty Owner for whom royalty payments due to you by Columbia under a natural gas lease may have been underpaid.

The Basis Of The Claims Against Columbia

In this lawsuit, Plaintiffs contend that royalties due to the members of the Plaintiff Class have been underpaid. Plaintiffs allege that the royalty underpayment is the result of Columbia: (1) taking improper deductions in calculating the royalties; and (2) failing to obtain the highest price reasonably available for the gas. In this regard, Plaintiffs have asserted claims against defendant Columbia Natural Resources, Inc., for breach of contract, breach of the implied covenant to market in good faith, breach of fiduciary duty, an accounting and declaratory and injunctive relief. Plaintiffs have also asserted claims against Defendants Columbia Gas tortious interference with contractual relations and declaratory and injunctive relief. Plaintiffs seek money damages against Defendants, as well as declaratory and injunctive relief.

The Proposed Settlement

a) One or more Defendants shall make an aggregate payment of One Million Eight Hundred Fifty Thousand Dollars ($1,850,000.00) to royalty owners in the Plaintiff Class. This payment will represent payment in full of all damages from January 1, 1994 through the date of settlement, plus interest thereon, attorneys’ fees, consultant and expert fees, costs and disbursements, and any other costs or expenses of any kind relating to the allegations raised, or which could have been raised, in the Second Amended Complaint. None of the settlement proceeds represents payment for punitive or exemplary damages.

b) In the future, Defendants may make limited deductions from the amount used to calculate royalty payments and may take no deductions for compression, or dehydration and other costs incurred by them, as specified by the Settlement Agreement. Estimated future savings to class members as a result of this agreement approximates at least One Million Two Hundred Thousand Dollars ($1,200,000.00).

c) through i) Etc., etc.

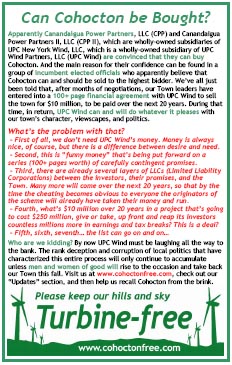

Cohocton residents should be prepared to mount similar legal actions in the future against UPC Wind, Canandaigua Power Partners I, Canandaigua Power Partners II, LLC, etc., etc. They won't be able to use the excellent legal services of the Harris Beach firm, however, since Harris Beach would be representing the Defendents in this case.

Labels: Process